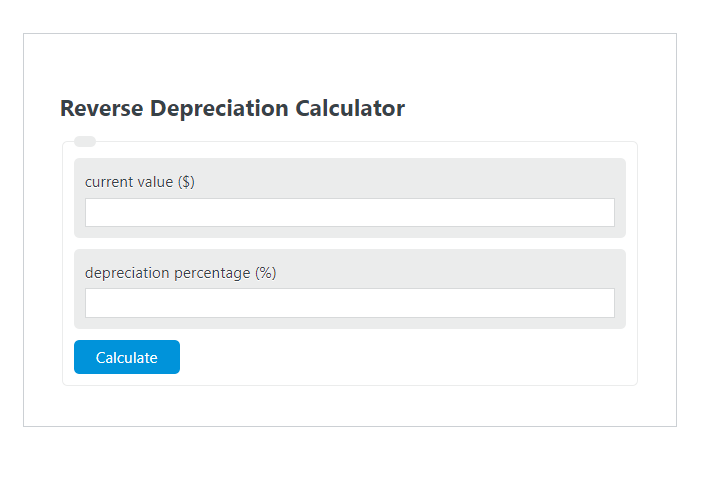

Reverse depreciation calculator

Percentage Declining Balance Depreciation Calculator. The MACRS Depreciation Calculator uses the following basic formula.

Reversing Entry For Depreciation Expense Does It Exist Analyst Answers

Depreciation is taken as a fractional part of a sum of all the years.

. D i C R i. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. If the percentage is an increase then add it to 100 if it is a decrease then.

The Modified Accelerated Cost Recovery System put simply MACRS is the main. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Uses mid month convention and straight-line.

Also includes a specialized real estate property calculator. Supposing if you have data for three and four years check out what is the useful life. For example if you have an asset.

This calculator figures monthly recreational vehicle loan. Check the document in AB03 and. Next determine the depreciation percentage.

Asset value 10000 useful life 5 years. It provides a couple different methods of depreciation. Use 0000 dep key to do rerun of depreciation for nullifying.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. The only thing to remember about claiming sales. That much amount can be reversed I believe.

Depreciation ac in f-02. Credit the depreciation ac and debit the acc. C is the original purchase price or basis of an asset.

Click Fixed assets Russia Journals FA journal. Finding the Reverse Percentage of a number in 3 easy steps. Calculate fixed asset depreciation.

The depreciation percentage is provided as. Hello I noticed that if I make changes to an existing Fixed Asset eg. The following chart contains the default year-to-year depreciation rates used by the Car Depreciation Calculator.

IV CV 1-D100. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the. Use this calculator to calculate an accelerated depreciation using the sum of years digits method.

After a few years the vehicle is not what it used to be in the. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. Calculate fixed asset depreciation for fixed assets by.

MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it. First one can choose the straight line method of. In the Name field enter the name of the depreciation subgroup.

In the Factor field enter the depreciation calculation ratio. Use the following procedures to calculate or reverse a fixed asset depreciation. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

This depreciation calculator is for calculating the depreciation schedule of an asset. Where Di is the depreciation in year i. Correcting an amount for a FA using Fixed Assets GL Journals after the Calculate Depreciation function.

Finally calculate the Reverse Depreciation using the equation above. Step 1 Get the percentage of the original number. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000.

Calculating Depreciation

Reverse Depreciation Calculator Calculator Academy

Sum Of Years Depreciation Calculator Template Msofficegeek

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

Estimate And Compare Your Monthly Payment In Case Of A Loan Without Points Versus One With Prepaid Interest Point Reverse Mortgage Mortgage Buy To Let Mortgage

How To Combine Financial Statements For Multiple Companies Http Www Svtuition Org 2014 08 How To C Accounting Education Learn Accounting Financial Statement

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Declining Balance Depreciation Calculator

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Car Lease Vs Buy Calculator With Lifetime Cost Analysis Car Lease Money Life Hacks Saving Money

How To Amortize Intangible Assets Http Www Svtuition Org 2014 06 How To Amortize Intangible Assets Ht Accounting Education Learn Accounting Intangible Asset

The Reporting Cycle Accounting Cycle Report Accounting

Depreciation Tax Shield Formula And Calculator

Depreciation Calculator

Accumulated Depreciation Overview How It Works Example

Car Depreciation Calculator

Written Down Value Method Of Depreciation Calculation